capital gains tax canada vs us

Since October 2000 the capital gains inclusion rate in Canada has been 50 meaning that upon the death of Canadian taxpayers half of any previously unrealized appreciation on capital assets gets taxed leading to tax at rates as high as 27 depending on the province of residence of the deceased taxpayer. As of May 31 2021 Canadas country weight within the MSCI All Country World Index was less than 3.

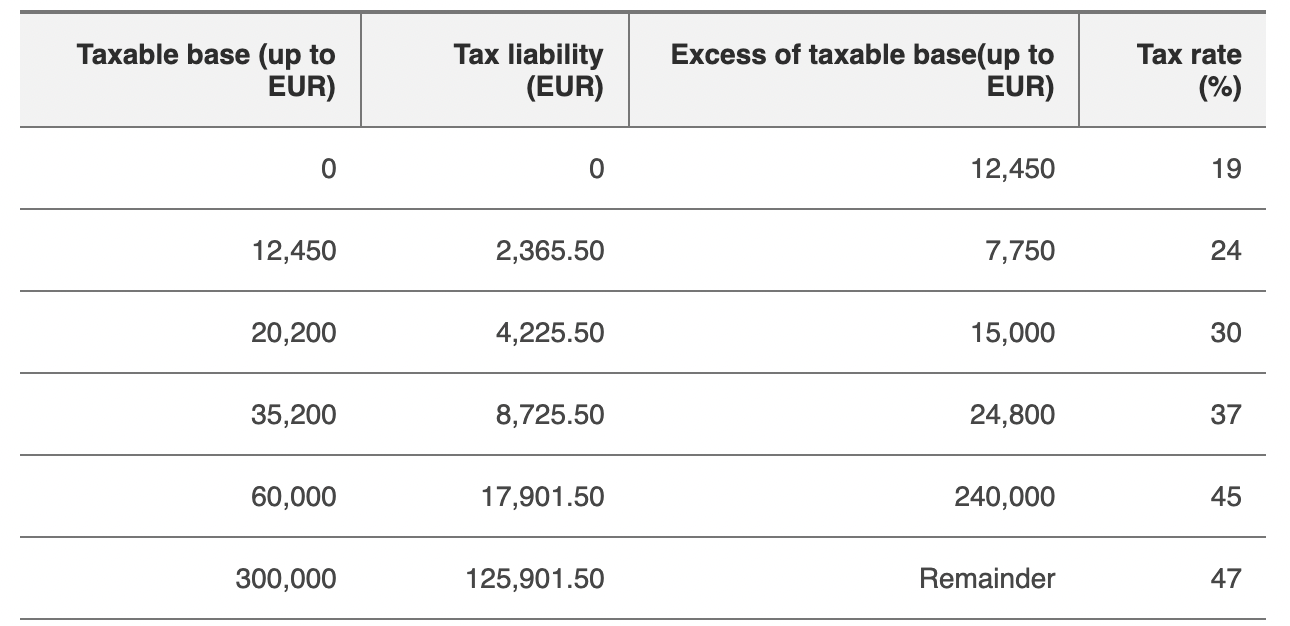

Expat Taxes In Spain 2022 Non Resident Tax Rates Spain

Capital Gains Tax Question.

. Colombia Last reviewed 11 January 2022 10. In our example you would have to include 1325 2650 x 50 in your income. Income from capital gains counts as half so if youre very rich and live in Ontario your rate is about 23 and less than that in Alberta.

In Canada capital losses can only be used to reduce capital gains. Stocks represented almost 58. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains inclusion rate.

The sale price minus your ACB is the capital gain that youll need to pay tax on. Provinces also have a regular rate and small business deduction rate. For a Canadian who falls in a 33 marginal tax bracket the income earned from the capital gain of 25000 results in 8250 in taxes owing.

In Canada 50 of the value of any capital gains is taxable. The only way to match or beat this deal in the US in the long term is to live in a no-income-tax state. If losses are 3000 more than gains you can carry them forward.

Capital Gains Tax By State - 17 images - non qualified stock options vs rsus strategy guide level up how much is us capital gains tax tax walls united states where can i see the local tax rates on capital gains lowest and highest property taxes tax foundation. If capital losses in one year are more than capital gains you can use it to reduce capital gains in up to three previous years or any future year. My wife is a sole owner of a rental property for the last 4 years that.

At present US citizens are exempt from the US estate tax on the first US 512 million of value of the estate. For dispositions of qualified farm or fishing property QFFP in 2021 the LCGE is 1000000. I am a sole owner of a rental property for the last 3 years I am now going to be selling the property and will mostly likely make some money on the sale and I understand that I will have to pay Capital Gains tax on 50 of the gain.

A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen. The amount of tax youll pay depends on. Canada taxes nonresidents at a rate of 25 on capital gains realized from the.

The tax rate for these transactions is identical to the individuals marginal tax rate. Capital gains are taxed at a lower rate than ordinary income. The capital gains tax rate in Ontario for the highest income bracket is 2676.

Canadian investors are forced to pay capital gains tax on 50 of their realized capital gains. Prior to 1972 Canada also had an estate tax. The average Canadian home.

If the assets were held for less than two years the gain will. This eliminates most but not all of US estates from the application of the estate tax. And the tax rate depends on your income.

Your income tax rate bracket is determined by your net income which is your gross income less any contributions to registered investment accounts. If the assets were held for two or more years the gain will be taxed as a capital gain at a 10 flat rate recapture rules are applicable. At present US citizens are exempt from the US estate tax on the first US 512 million of value of the estate.

The long-term capital gains tax rate is 15 for most taxpayers while the short-term capital gains tax rate is your ordinary income tax rate. In the US capital losses can reduce capital gains and up to 3000 of regular income. On the other hand business.

Capital gains tax canada vs us. The actual gain in this example would be 3200 your full gain of 3400 minus the 200 of currency gains that Canada Revenue Agency allows you to have without paying taxes. The federal corporate tax rate is much lower 15 in Canada vs 34-35 in the US - yes only 15 - you American read that correctly The small business deduction reduces the federal corporate tax rate to 11 on the first 500000 in taxable income.

Because you only include one-half of the capital gains from these properties in your taxable income your cumulative capital gains deduction is 446109 half of 892218. At its highest marginal rate the US estate tax is presently at 35 percent. Marginal tax rates are composed of a federal component which is paid in the same amount by all Canadians and a provincial component which varies depending on which province you live in.

In Canada you only pay tax on 50 of any capital gains you realize.

Capital Gains Tax What It Is How It Works Seeking Alpha

How To Pay 0 Capital Gains Taxes With A Six Figure Income

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Canada Tax Income Taxes In Canada Tax Foundation

Us Expat In Canada Canada Pension Plan Rental Income Filing Taxes

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Top 10 Crypto Tax Free Countries 2022 Koinly

2022 Capital Gains Tax Rates By State Smartasset

Capital Gains Tax Capital Gain Term

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

How Do Taxes Affect Income Inequality Tax Policy Center

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Difference Between Income Tax And Capital Gains Tax Difference Between

Que Iva Me Puedo Deducir De Mis Gastos Comunes Como Autonomo Filing Taxes Income Tax Tax Preparation

Difference Between Income Tax And Capital Gains Tax Difference Between

Capital Gains Tax What Is It When Do You Pay It

Capital Gains Tax Or Income Tax Which Is Better For You Capital Gains Tax Income Tax Capital Gain